operating cash flow ratio industry average

The operating cash flow ratio formula is. Each ratio reveals a specific financial aspect of the company.

Leverage Ratio What It Means And How To Calculate It

Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is.

. Cash ratio is a refinement of quick ratio and. The current liability coverage ratio also called the cash current debt. Restaurants Industry experienced contraction in Operating Profit by -2764 and Revenue by -602 while Operating Margin fell to 998 below Industrys average Operating Margin.

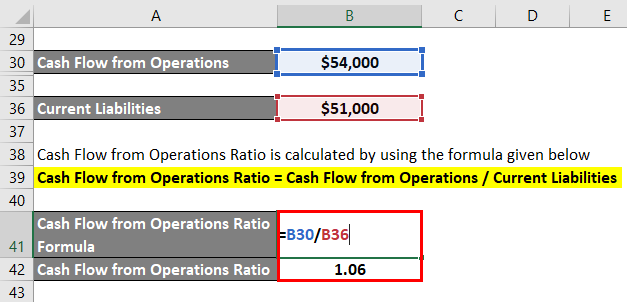

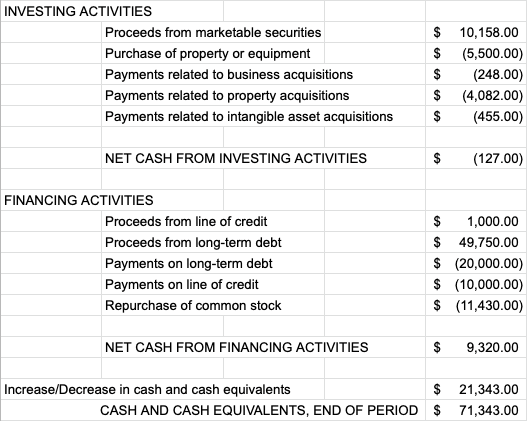

On the trailing twelve months basis Oil And Gas Production Industry s ebitda grew by 5034 in 2 Q 2022 sequentially faster than total debt this led to. They use some ratios more frequently used than others depending on the business and its financial needs. Operating cash flow ratio Operating cash flow Current liabilities.

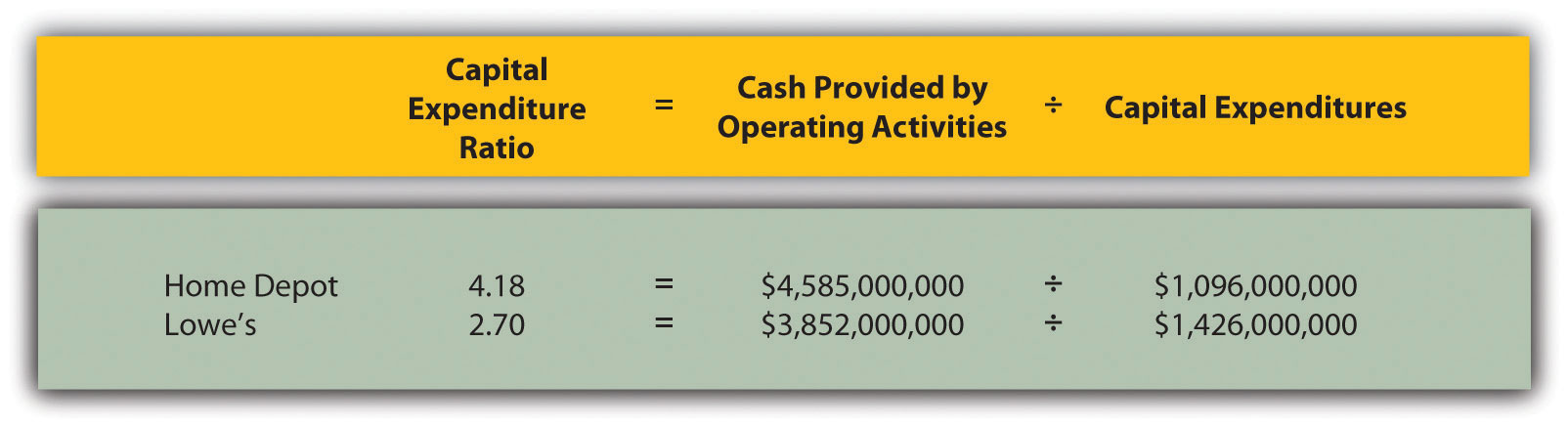

This corresponds to a value of 1 or little higher than 1. Operating Cash Flow Margin. Here are six types of cash flow ratios common in financial analyses.

872 975. OCR Ratio Cash flow from operating activities Current liabilities. Current liability coverage ratio.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Operating cash flow ratio industry average Sunday July 24 2022 Edit. Operating cash flow ratiofrac operating cash flow current liabilities operating cash f low ratio current liabilitiesoperating cash f low.

Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR. Debt Coverage Ratio Comment. The average for each of these annual figures over the complete 20 year period was 143Compare this to the 89 average from the research I did on historical average net.

A higher than industry. Liquidity Ratio Formula And Calculation Examples Cash Flow Per Share Formula Example How To. 75 rows Cash Ratio - breakdown by industry.

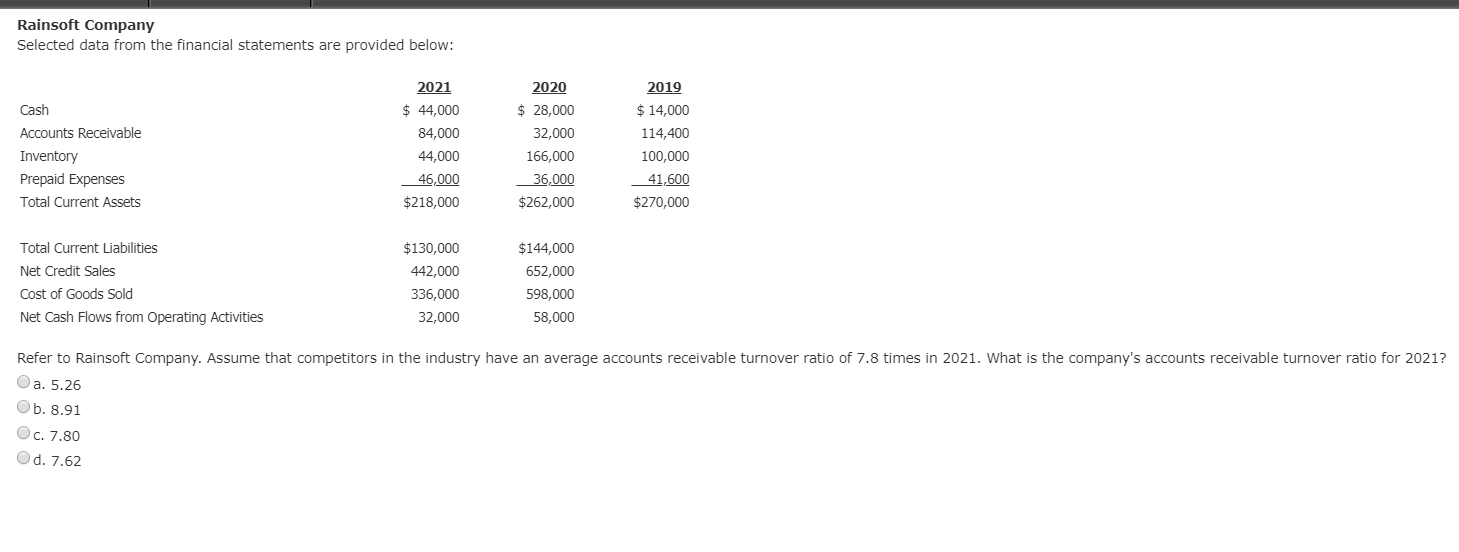

Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. The formula to calculate the ratio is as follows.

Cash Flow Ratios Calculator Double Entry Bookkeeping

Cash Flows Balances And Buffer Days Jpmorgan Chase Institute

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Operating Cash Flow Ratio Definition And Meaning Capital Com

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Free Cash Flow To Operating Cash Flow Ratio Accounting Play

Cash Flow Analysis Basics Benefits And How To Do It Netsuite

Solved Which Of The Following Is A Measure Of Chegg Com

Cash Flow Coverage Ratios Aimcfo

Price To Cash Flow P Cf Formula And Calculator Step By Step

Cash Flow From Operations Ratio Formula Examples

6 Types Of Cash Flow Ratios And How To Use Them Indeed Com

Price To Cash Flow Formula Example Calculate P Cf Ratio

How To Do A Cash Flow Analysis With Examples Lendingtree

Analyzing Cash Flow Information